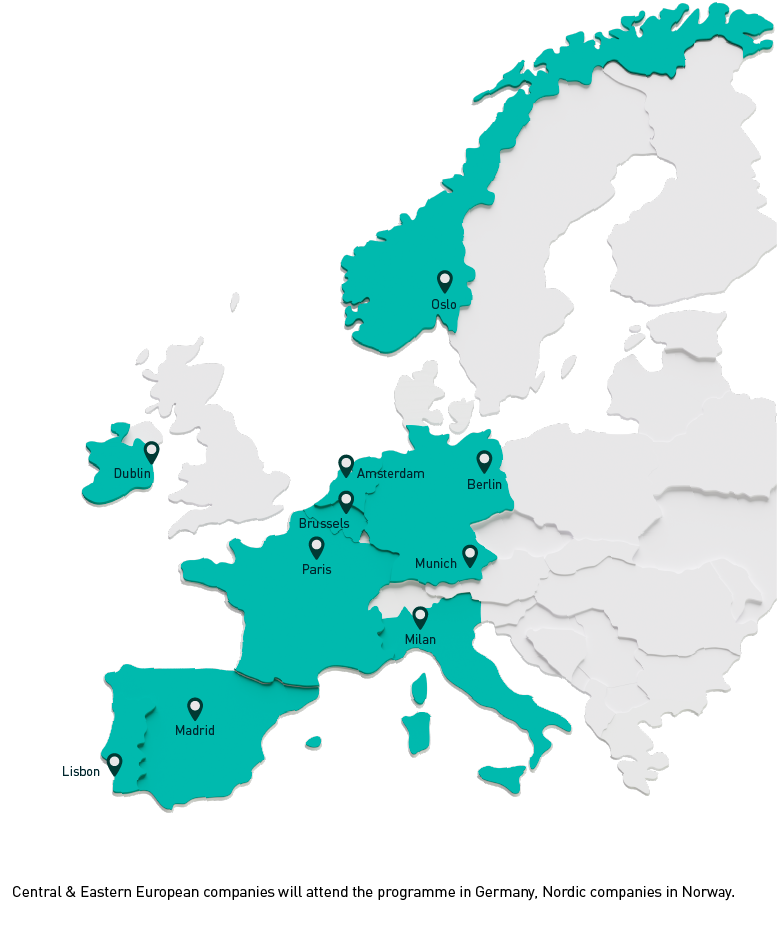

IPOready also offers a special track for private companies with strong founder ownership, particularly adapted to family-owned businessess. This track offers guidance on succession planning, governance structures, and managing family dynamics, as well as resources on attracting and retaining institutional investors.

Innovating the IPOready programme, by introducing a brand new community platform aiming to improve our stakeholders’ experience and to facilitate the networking activity within the cohort. The new community platform is the all-in-one place for everything you need to know during the programme, aiming to: